A recent OECD study found that the gap between mean net wealth and median net wealth is at least worrying. As Portfolio.hu reports, net wealth is highest in the US, while in Hungary it is among the lowest ones.

While Hungary celebrated its 20th anniversary in OECD in 2016 and just joined an OECD multilateral tax agreement, the country is not making so good scores on OECD’s recent rankings. The recent study concentrated on the wealth gap to understand economic well-being in OECD countries, with a focus on income and wealth inequality. As the report says, wealth inequality is twice the amount of income inequality. This means that the wealthiest 10 pc have control over 50 pc of net wealth. In comparison, the top 10 pc of income distribution „only” hold 24 pc of total income.

Wealth inequality was measured to be the highest in the United States and the Netherlands, while the lowest in the Slovak Republic and Japan. Interestingly, households with the lowest wealth are not necessarily those with the lowest incomes – this may be due to the high level of debt despite advantageous income.

Based on the study’s findings regarding the distribution of wealth among OECD countries, we are seriously lagging behind.

The report looked at many measures and indicators to collect supporting data: levels of median wealth, wealth inequality, the relationship between wealth and income, and characteristics of households.

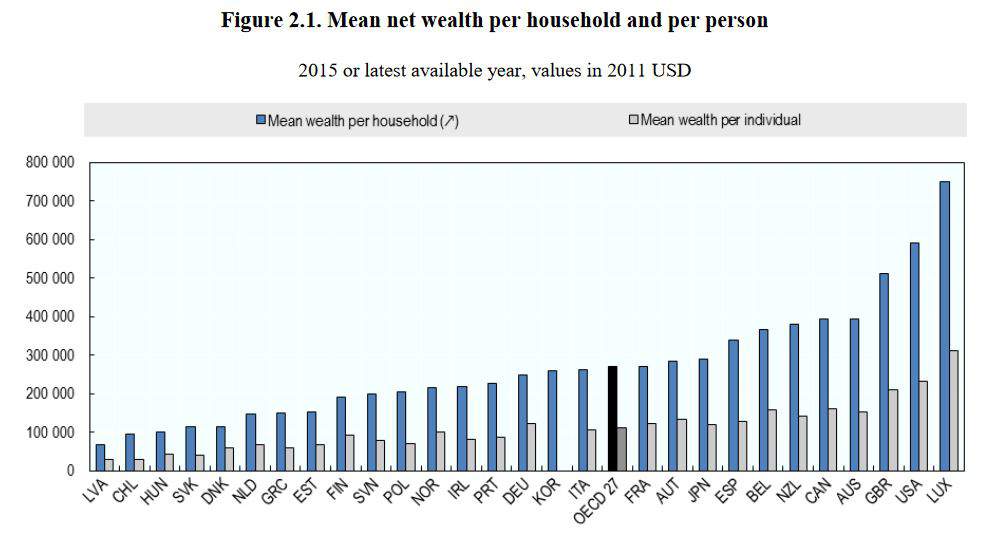

Net wealth is highest in Luxembourg, the United States, the United Kingdom, and lowest in Chile and Hungary.

Perhaps an, even more, scarier perspective is the level of wealth inequality. The bigger the difference between mean net wealth and median net wealth is, the wider is the gap between the average, ’typical’ household and the wealthiest 10 pc. Across the OECD countries, mean net wealth is 2,6 higher than median net wealth, which is a huge difference between various economic classes of society.

In Hungary, the bottom 60 pc share 15,4 pc of total net wealth, while the top 10 pc share is 48,5 pc out of total net wealth.

Household wealth composition must be regarded with special attention to wealth distribution in- and across countries. Naturally, the gross value of assets is low in the bottom wealth quintile in most countries. On the contrary, in the Netherlands, Ireland, Denmark and Norway, the average value of assets in this quintile is relatively high. Financial assets prove to be more important in the top quintiles and are more unequally distributed than non-financial ones in all countries.

In all countries, the largest share of gross assets is still real estate.

Mean net wealth has undergone a considerable change after the great recession. This impact has been mostly felt by younger generations: mean net wealth has decreased in households of youngsters, under age 35 in Australia, the United Kingdom, and other countries.

The recession has also made an impact on indebtedness: more than half of the households are in some kind of debt. 85 pc of debts stem from real estate debts, mortgage or loans related to the purchase of a property.

In Hungary, 40 pc of households are struggling with debt.

Featured image: MTI